|

March 27, 2022

Arizona Corporation Commission 1200 W. Washington Street Phoenix, AZ 85007 Re: Salt River Project (SRP) Certificate of Environmental Compatibility (CEC), Docket No. L-00000B-21-0393-00197 Madam Chair and Commissioners, Our organizations submit these joint comments to urge you to deny SRP’s CEC rehearing request. We support the Commission’s decision on April 12th to deny SRP’s CEC. The reasons for that denial remain. To summarize our opposition to the CEC:

Like SRP, nearly every large utility in Arizona is both experiencing and projecting load growth. Unlike SRP, other utilities are not proposing major gas expansions to meet demand. Utilities around the country are investing in storage[5] and they are doing it within the same timeframe as the CEP.[6] Unfortunately, some AriSEIA members have incurred substantial delays and large costs because of SRP’s unfamiliarity with storage. This is a missed opportunity we hope SRP chooses to correct, instead of pursuing major gas investments. Stakeholders stand ready to engage with SRP when it is ready to comply with its own IRP and conduct a competitive bidding process for new resources. We also encourage all utilities to allow stakeholder review of all-source RFPs before their release, as Arizona Public Service (APS) has done with its most recent RFP. We ask the Commission to deny this CEC rehearing request. Respectfully, Autumn T. Johnson Executive Director Arizona Solar Energy Industries Association (AriSEIA) [email protected] 520-240-4757 Bret Fanshaw Western Region Director Solar United Neighbors (SUN) [email protected] 602-962-0240 Yaraneth Marin Interior West Regional Director Vote Solar [email protected] 602-492-6077 [1] Salt River Project, Integrated Resource Plan Report, P.49, available here https://srpnet.com/about/stations/pdfx/2018irp.pdf. [2] February 15, 2022 Hearing Transcript, starting at P.1118, L.9-10, available here https://srpnet.com/electric/transmission/projects/Coolidge/pdfx/cec/07_02-15-2022_SRP_Coolidge_Expansion_Evidentiary_Hearing.pdf. [3] Id. at 1121, L.1-3. [4] ARS 40-360.06(A)(8) available here https://www.azleg.gov/ars/40/00360-06.htm. [5]See PV and Energy Storage Expected to Comprise 62% of US Capacity Additions 2022-23, PV Magazine, available here https://www.pv-magazine.com/2021/12/28/pv-and-energy-storage-expected-to-comprise-62-of-us-capacity-additions-2022-23/; US Energy Storage Developers Plan 9 GW in 2022, Building on 2021 Breakthrough, S&P Global, available here https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/us-energy-storage-developers-plan-9-gw-in-2022-building-on-2021-breakthrough-68012433; Solar and Battery Storage Make Up 60% of Planned New US Electric Generation Capacity, Electrek, available here https://electrek.co/2022/03/07/solar-and-battery-storage-make-up-60-of-planned-new-us-electric-generation-capacity/#:~:text=Power%20plant%20developers%20and%20operators,Energy%20Information%20Administration%20(EIA); Trends to Watch in Energy Storage in 2022, Utility Dive, available here https://www.utilitydive.com/spons/trends-to-watch-in-energy-storage-in-2022/610870/. [6] California Regulator CPUC Approves Utility SCE’s Fast-Tracked 500MW BESS Projects, Energy Storage, available here https://www.energy-storage.news/california-regulator-cpuc-approves-utility-sces-fast-tracked-500mw-bess-projects/.

0 Comments

AriSEIA Submits Letter to ACC Indicating Intention to Serve on the Community Solar Working Group5/25/2022 May 25, 2022

Arizona Corporation Commission 1200 W. Washington Street Phoenix, AZ 85007 Re: APS 2022 RES Implementation Plan, Docket No. E-01345A-21-0240 and Generic Community Solar Docket, E-00000A-22-0103 Madam Chair and Commissioners, Vote Solar, Solar United Neighbors (SUN), the Arizona Solar Energy Industries Association (AriSEIA), and the Institute for Local Self-Reliance (ILSR) appreciate the opportunity to respond to the discussion preceding the passage of Commissioner Tovar’s 3rd Revised Amendment #1 during the May 18, 2022 Open Meeting. Our organizations thank the Commissioners for their support of this amendment and we look forward to participating in the community solar working group. We seek to offer clarification regarding the work of our organizations and intent of the national petition mentioned during the Open Meeting. We believe that the decision to remove our organizations from the amendment is based on a misunderstanding of our support for a petition to the Federal Trade Commission (FTC).[1] We joined the petition because it seeks to protect consumers from financial scandals and antitrust violations by utilities. The petition does not question or limit the Commission’s authority to regulate utilities in the state, nor does our support for it implicate the good faith efforts our groups have undertaken to build consensus among the solar industry, the utility, and advocates regarding a community solar program in Arizona. We would be happy to meet with any Commissioners interested in the petition to explain its substance and intent in greater detail. AriSEIA, SUN and Vote Solar all have an established record of engagement at the Commission, where we are committed to working in good faith to support a transition to clean energy in Arizona. Similarly, ILSR maintains a positive record of engagement on regulatory issues around the country. We hope that this letter serves to clarify our commitment to advancing community solar in Arizona through the collaborative process approved by the Commission. We look forward to working with all stakeholders involved in the working group and to the Commission’s consideration of the recommendations that result from the working group in November. Respectfully, Autumn T. Johnson Executive Director Arizona Solar Energy Industries Association (AriSEIA) [email protected] Bret Fanshaw Arizona Program Director & West Region Director Solar United Neighbors (SUN) [email protected] Kate Bowman Interior West Regulatory Director Vote Solar [email protected] John Farrell Co-Director of ILSR & Director, Energy Democracy Initiative Institute for Local Self-Reliance (ILSR) [email protected] [1] FTC Legal Petition and Press Release, available here https://biologicaldiversity.org/w/news/press-releases/egal-petition-seeks-federal-trade-commission-investigation-of-energy-utility-abuses-2022-05-18/. AriSEIA signed on to a petition drafted by the Center for Biological Diversity, Solar United Neighbors, Open Markets Institute, Energy and Policy Institute, and Institute for Local Self-Reliance. The petition asks the Federal Trade Commission (FTC) to investigate the electric utility industry for widespread abuses. These include bribery, fake dark-money campaigns, and denying customers access to renewable energy. More than 230 consumer, environmental and public interest groups signed the petition. You can read the petition and press release below.

AriSEIA Calls on AZ Congressional Delegation to Sign on to House Auxin Solar Tariff Letter5/18/2022 AriSEIA has called on Arizona House of Representatives members to join in a joint letter from the House to the Department of Commerce to issue a swift preliminary determination to protect US solar jobs and reach climate goals. You can see similar content from Solar Energy Industries Association (SEIA), below.

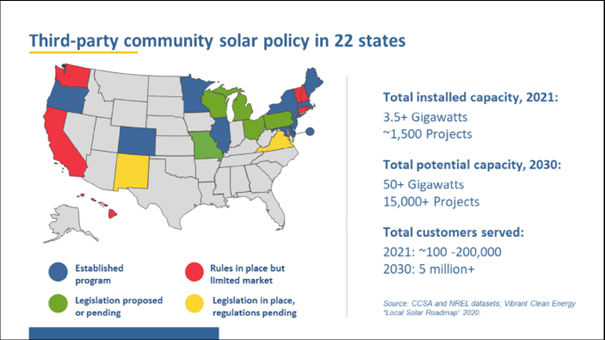

May 13, 2022 Arizona Corporation Commission 1200 W. Washington Street Phoenix, AZ 85007 RE: Community Solar Support in Docket No. E-01345A-21-0240 Madam Chair and Commissioners, The Arizona Solar Energy Industries Association (AriSEIA) very much supports the Commission in an effort to move forward with community solar. Community solar provides a unique opportunity for residential and small business customers to participate in the clean energy transition when they otherwise would not be able to. Community solar is a useful opportunity for those that cannot utilize rooftop solar for practical or financial reasons to be able to join together in projects that are at strategically valuable locations, still close to distribution opportunities. It also provides a way to utilize otherwise underutilized brownfield and agricultural sites. AriSEIA has many member companies that are very interested in investing in Arizona. Community solar provides another avenue for the solar industry to encourage job creation and economic growth in our state. As noted by the Coalition for Community Solar Access (CCSA), several university studies have been conducted that reflect the job and revenue opportunities for states that adopt community solar policies.[1] Failure to act allows other states, including some of our neighbors, to seize those opportunities from us, including New Mexico, Colorado, and California. Arizona should be a leader in solar in the nation. We encourage the Commission to signal to the industry that Arizona very much wants those jobs and investment dollars. We are eager to participate in the working group and feel confident that collaboration with other organizations, consumer advocates, Staff, and the utility will contribute to a better outcome. While there may not be consensus today on what the outcome of the group should be, Commissioner Kennedy’s Proposed Amendment No. 1 is an especially important step towards creating a thoughtful and workable program.[2] AriSEIA encourages the Commission to utilize the working group to explore all of these numerous benefits, as well as utilize the lessons learned from other states that have already adopted community solar policies. All of the details need not be fleshed out today, as that is the very purpose of the working group. AriSEIA is aware that there are presently two different avenues put forward as to how to commence with community solar in Arizona. We do not feel these opportunities are incompatible with each other. We fully support moving forward with a working group in the Arizona Public Service (APS) Renewable Energy Standard and Tariff (REST) docket, as well as utilizing the new docket for fact finding and programs in other service territories if a REST docket is unavailable. We urge the Commission to move forward with a working group in this docket at the May Open Meeting and recommend that a final vote on the outcome of the working group be scheduled for the October Open Meeting. Respectfully, /s/ Autumn T. Johnson Executive Director AriSEIA (520) 240-4757 [email protected] [1] Coalition for Community Solar Access, May 13, 2022 Letter, available here https://docket.images.azcc.gov/E000019242.pdf. [2] Commissioner Kennedy Proposed Amendment No. 1, available here https://docket.images.azcc.gov/E000018712.pdf?i=1652155834150. BEFORE THE ARIZONA CORPORATION COMMISSION

COMMISSIONERS Lea Márquez Peterson – Chairwoman Sandra Kennedy Justin Olson Anna Tovar Jim O’Connor IN THE MATTER OF THE APPLICATION OF ARIZONA PUBLIC SERVICE COMPANY FOR A HEARING TO DETERMINE THE FAIR VALUE OF THE UTILITY PROPERTY OF THE COMPANY FOR RATEMAKING PURPOSES, TO FIX A JUST AND REASONABLE RATE OF RETURN THEREON, AND TO APPROVE RATE SCHEDULES DESIGNED TO DEVELOP SUCH RETURN. Docket No. E-01345A-19-0236 Arizona Solar Energy Industries Association (AriSEIA) Comments on Arizona Public Service (APS) Efforts to Comply with Order Relating to Rate Schedule E-32 L Storage Pilot in Decision No. 78317 We appreciate the Commission’s decision to include AriSEIA/SEIA in collaborative discussions with APS on the rate design elements and intended success of the E-32 L Storage Pilot (SP) plan.[1] Background The E-32 L SP tariff was established in December 2017 as a result of APS’ previous rate case with the intention to evaluate the opportunity of large-scale, behind-the-meter energy storage solutions as a value-added benefit to the grid while allowing for high demand (as determined by 15-minute interval kilowatt readings) customers to benefit from peak shaving.[2] Due to several issues, including poor rate tariff mechanics and imbalanced Cost of Service (COS) formulas (notably with lower per-kW rates than the non-pilot, base E-32 L rate tariff), the pilot program offering did not facilitate subscription from any customers. Decision No. 78318 and Current Status AriSEIA/SEIA offered testimony that the E-32 L SP rate schedule required re-evaluation. The Commission ordered APS to do the following:

Subsequent to the order, APS filed its revised rate tariff on December 1, 2021, and held its first stakeholder engagement meeting on February 23, 2022. AriSEIA/SEIA maintains that while APS is complying with the letter of the order, the spirit of the decision is being left to stakeholders to enforce. Key Issues on Proposed E-32 L SP Rate Plan and Discussion It is AriSEIA’s understanding that the intent of this pilot program is to facilitate adoption of energy storage for APS’ large commercial customer class up to 35 megawatts (MW) of installed capacity, and to that end, we submit the following feedback for consideration:

Due to the nature of variability between customer load profiles (predictability of peaks depending on facility type), the economics of energy storage vary significantly from project-to-project. Furthermore, the value proposition (i.e., return on investment), depends on whether or not a customer can monetize federal tax incentives directly. Although pending federal legislation includes a change which provides tax credits to ‘storage only’ projects, the current Internal Revenue Code only allows energy storage customers to claim available tax incentives when the storage systems are charged by solar energy (at least 75%) throughout the operational year.[6] Given that many APS E-32 L customers are tax-exempt and the fact that this tariff is unlikely to support solar projects in conjunction (i.e. tax credits will not be available), we believe it is critical that the tariff be designed in a way that provides sufficient economic incentive to pursue pilot projects for all interested customers. Conclusion Energy storage systems represent significant investments and require a precise and reliable method for return on investment. We submit that the spirit of the Order requires that APS demonstrate a thoughtful and comprehensive approach to the design of the E-32 L SP rate tariff, and we recommend an approach that leverages optionality and increased on-peak vs. off-peak differentials. As it stands, it is AriSEIA’s position that the current E-32 L SP rate plan will not facilitate any adoption toward the cap of 35 MW without substantial changes, and we recommend the Commission direct APS to issue revised rate tariff options that will provide further opportunities for customer adoption. We thank the Commission and its staff for the opportunity to submit these comments. Respectfully submitted this 6th day of May, 2022. /s/ Autumn T. Johnson Executive Director Arizona Solar Energy Industries Association (AriSEIA) [email protected] 520-240-4757 /s/ John Mitman Board President Arizona Solar Energy Industries Association (AriSEIA) [email protected] 480-251-2934 [1] See APS 2019 Rate Case, Docket No. E-01345A-19-0236, Decision No. 78317, available here https://docket.images.azcc.gov/0000205236.pdf?i=1650001754509. [2] See APS 2017 Rate Case, Docket No. E-01345A-16-0036, available here https://edocket.azcc.gov/search/docket-search/item-detail/19348. [3] National Renewable Energy Laboratory, Identifying Potential Markets for Behind-the-Meter Battery Energy Storage: A Survey of U.S. Demand Charges, available here https://www.nrel.gov/docs/fy17osti/68963.pdf. [4] Southern California Edison, Schedule TOU-8 Time-of-Use - General Service – Large (Option E), available here https://www.sce.com/regulatory/tariff-books/rates-pricing-choices and included as Attachment A. [5] National Renewable Energy Laboratory, Storage Futures Study, available here https://www.nrel.gov/analysis/storage-futures.html. [6] National Renewable Energy Laboratory, Federal Tax Incentives for Energy Storage Systems, available here https://www.nrel.gov/docs/fy18osti/70384.pdf. |

AriSEIA NewsKeep up with the latest solar energy news! Archives

July 2024

Categories

All

|

NEWS

See what AriSEIA is up to on the policy front.

The Arizona Solar Energy Industries Association (AriSEIA) is a 501(c)(6) non-profit trade association representing the solar, storage, and electrification industry, solar-friendly businesses, and others interested in advancing complementary technologies in Arizona. The group's focus is on education, professionalism and promotion of public policies that support deployment of solar, storage, and electrification technologies and renewable energy job growth and creation. |

FOLLOW Us |

Copyright © 2019 AriSEIA - All Rights Reserved

RSS Feed

RSS Feed